Towards a healthy understanding: American university interns help highlight differences between UK and US medical systems

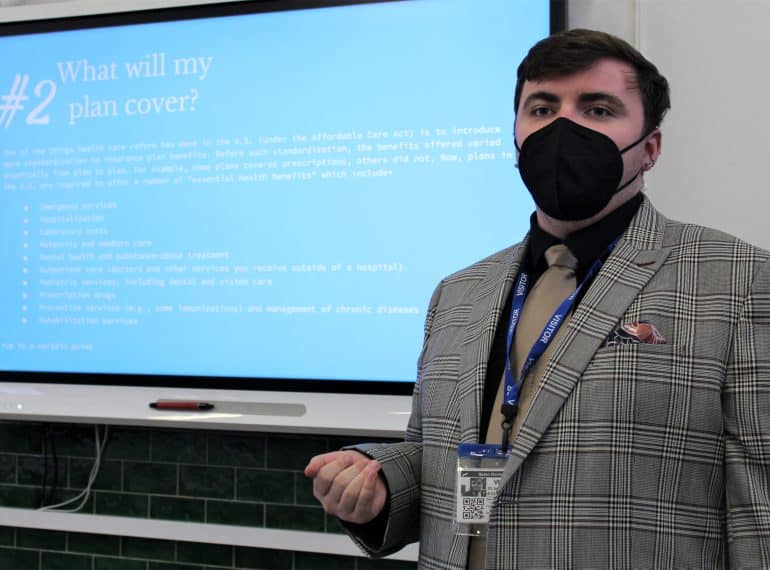

Three interns from the University of Connecticut helped deepen boys’ knowledge of American healthcare at a meeting of QE’s Personal Finance Society.

Pupils heard about the high costs and complexity inherent in the US system, with the session ending in a discussion of the pros and cons of healthcare on both sides of the Atlantic.

The meeting was organised by Ugan Pretheshan, who runs the society along with fellow Year 11 pupil Roshan Patel with the aim of helping boys manage their finances both now and in the future in their adult lives. Other topics covered in its meetings include buying a house and maintaining a good credit score.

Headmaster Neil Enright said: “I am grateful to our three current interns, Evan Burns, Nathaniel Austin-Mathley, and Ben Duncan, for their contribution to this meeting and to our enrichment programme more generally. Our relationship with the University of Connecticut extends back over a number of years and it is great that we can again welcome interns this year. It is a connection which gives us fascinating insights into the differences in pedagogy and educational culture between our respective countries.

Headmaster Neil Enright said: “I am grateful to our three current interns, Evan Burns, Nathaniel Austin-Mathley, and Ben Duncan, for their contribution to this meeting and to our enrichment programme more generally. Our relationship with the University of Connecticut extends back over a number of years and it is great that we can again welcome interns this year. It is a connection which gives us fascinating insights into the differences in pedagogy and educational culture between our respective countries.

“Their presence allows boys here to more readily make international comparisons and to understand different contexts and policy approaches: the opportunity thus to interrogate a different system is valuable, not least in helping pupils think critically about our own systems.”

“I congratulate Ugan and Roshan on their work with the society: like other pupil-run societies, it is of great benefit both to those who lead it and to those who attend. The Personal Finance Society complements the work of my colleagues who teach topics such as personal finance and other life skills through formal programmes of study, such as QE’s Personal Development Time programme.”

During the meeting, which was overseen by Economics teacher Sheerwan O’Shea-Nejad, the three History interns spoke extensively on American healthcare, telling the boys that it is a complex system that leaves many suffering, both physically and financially.

US healthcare spending grew 9.7 per cent in 2020, they said, reaching $4.1 trillion, or $12,530 per person. As a share of the nation’s Gross Domestic Product, health spending accounted for 19.7 per cent.

“It was eye-opening to understand the complex and diverse methods of insurance and financing these large hospital bills,” said Ugan. The boys attending learned that insurance companies dominate US healthcare industries, presenting American citizens with a welter of quotation pathways and options – encompassing premiums, walk-in fees and ‘deductibles’ – that can be very difficult to understand. The contrast with the relative simplicity achieved by the NHS system in the UK was highlighted.

“It was eye-opening to understand the complex and diverse methods of insurance and financing these large hospital bills,” said Ugan. The boys attending learned that insurance companies dominate US healthcare industries, presenting American citizens with a welter of quotation pathways and options – encompassing premiums, walk-in fees and ‘deductibles’ – that can be very difficult to understand. The contrast with the relative simplicity achieved by the NHS system in the UK was highlighted.

The meeting also heard a story about what a woman who had got her leg caught between a train and the platform in the US told onlookers: “Don’t call an ambulance. It’s $3,000. I can’t afford that. Call an ‘Uber’.”

Asked what they would do in such a medical emergency in the UK, the boys responded that they would not hesitate to call an ambulance.

The interns, who are supporting the History, Politics and Religious Studies departments this term as part of their Master’s programme, happily answered boys’ questions, before the meeting concluded with a weighing-up of the advantages and disadvantages of both systems, with arguments about price, accessibility and waiting times all factors in the debate.