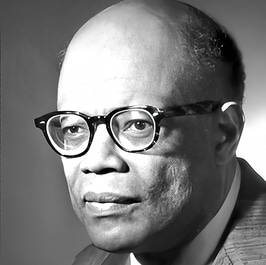

Old Elizabethan academic and economist Sandeep Mazumder queried the Bank of England’s 2% inflation target and suggested it should be higher – not because it is too cautious, but paradoxically because it is too risky.

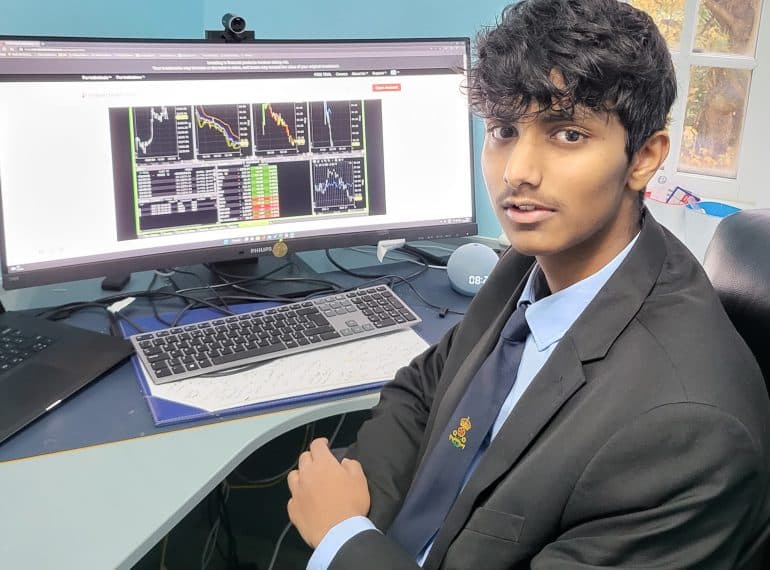

Sandeep (OE 1993–2000), who is Dean of Hankamer School of Business at Baylor University, Texas, spoke to the group of Year 12 economists before yesterday’s news that the inflation rate had fallen to 2.3%.

Although this is its lowest level in almost three years, the figure was still higher than expected. Political commentators believe that Prime Minister Rishi Sunak has called the early General Election on the strength of the apparently improving economic outlook.

Dean Sandeep, who has published widely on inflation dynamics and the Great Recession of 2007–2009, argued that inflation at 2% would limit the Government’s room for manoeuvre in cutting interest rates during times of economic difficulty, making it hard to escape a recession.

He argued instead for adopting a 3 or 4% target, which would give more flexibility with interest rate cuts, without the risk of inflation dropping to 0%. This is the level below which rates cannot be cut (the ‘zero lower bound’) without the potentially disastrous economic risk of people hoarding cash, rather than saving it in banks, the so-called ‘liquidity trap’.

Economics teacher Celia Wallace thanked Dean Sandeep, who spoke remotely to the School’s Gresham Society for Economics. He is a member of QE’s 450 Club member and has been very supportive of the Economics department.

“Sandeep introduced several new concepts to improve pupils’ depth of understanding, including the Fisher Equation to calculate real interest rates and the problem of the zero lower bound, which was the main basis of his talk.

“Within his critique of inflation targeting, Sandeep showed other policy options which countries can often consider, including price-level targeting – where a specific price index is targeted, rather than a growth rate.”

Afterwards, the sixth-formers asked a range of questions, including Avi Juneja’s cautious query about the issue of real wage cuts with a target of 3% or 4% inflation, and Abyan Shah asking about which method of targeting would be most effective for the UK: inflation targeting, price-level targeting, or average inflation targeting (a hybrid of both systems).

Sandeep gave plentiful career advice to all. He strongly expressed the need to follow one’s strengths and passions. He said he had chosen to go into academia and research as it was his passion, while also giving more of a life balance compared to other options, such as banking.

The first edition is contained within the pages of The Econobethan, the School’s well-established Economics and Politics magazine, but future editions are intended to be stand-alone publications.

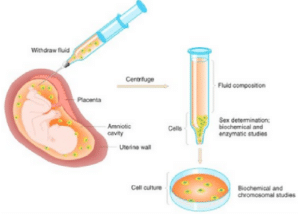

The first edition is contained within the pages of The Econobethan, the School’s well-established Economics and Politics magazine, but future editions are intended to be stand-alone publications. Seyed Jalili considers how the identification of CHIP (Clonal Hematopoiesis of Indeterminate Potential) in human blood cells might translate into effective treatments. Joshua John looks at the ethical implications of genetic screening in his piece entitled The Cost of a Human Life.

Seyed Jalili considers how the identification of CHIP (Clonal Hematopoiesis of Indeterminate Potential) in human blood cells might translate into effective treatments. Joshua John looks at the ethical implications of genetic screening in his piece entitled The Cost of a Human Life.

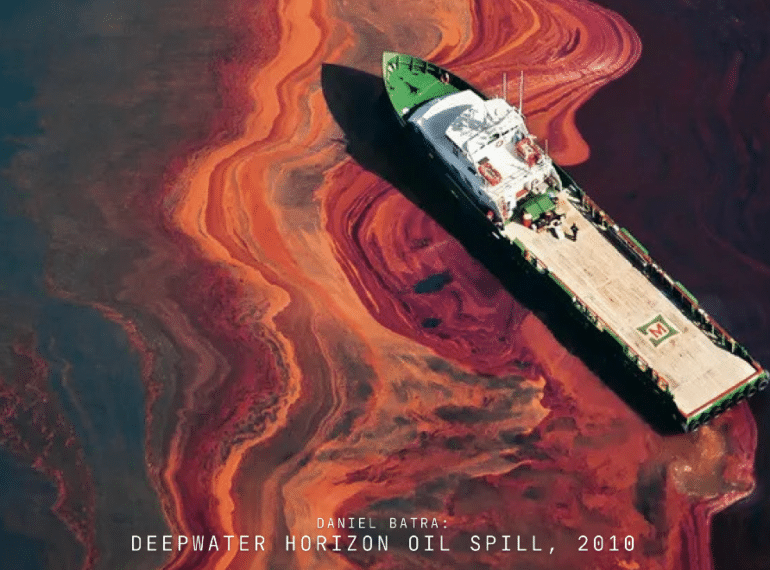

The special section devoted to Black History Month is followed by articles on Economics – including a look at the economic impact of AI – and Politics – where pupils express some forthright views on Prime Minister Rishi Sunak’s recent easing of green commitments.

The special section devoted to Black History Month is followed by articles on Economics – including a look at the economic impact of AI – and Politics – where pupils express some forthright views on Prime Minister Rishi Sunak’s recent easing of green commitments.

The festival featured academic tutorials and a lecture from Old Elizabethans, board games, a quiz, a meeting of QE’s Gresham Society for Economics and a special edition of the department’s periodical,

The festival featured academic tutorials and a lecture from Old Elizabethans, board games, a quiz, a meeting of QE’s Gresham Society for Economics and a special edition of the department’s periodical,  Head of Economics Shamendra Uduwawala said: “Our events had huge turnouts and the festival may be regarded as a great success. I am grateful to everyone who contributed. The boys enjoyed the board games, the quiz and our visiting speakers, while our senior students have once again raised the bar with the festival edition of The Econobethan, which includes some really spectacular work.”

Head of Economics Shamendra Uduwawala said: “Our events had huge turnouts and the festival may be regarded as a great success. I am grateful to everyone who contributed. The boys enjoyed the board games, the quiz and our visiting speakers, while our senior students have once again raised the bar with the festival edition of The Econobethan, which includes some really spectacular work.” Another highlight was a talk by economist and academic Sandeep Mazumder (OE 1993–2000), who is Dean of Hankamer School of Business at Baylor University, Texas.

Another highlight was a talk by economist and academic Sandeep Mazumder (OE 1993–2000), who is Dean of Hankamer School of Business at Baylor University, Texas. He wrote: “As my predecessor, Dr John Marincowitz (Headmaster 1999-2011), explained at this year’s Senior Awards Ceremony, when discussing his new published history of the School, the fortunes of the School have repeatedly been shaped by the political, economic and social context of the time. He emphasised that much of the interest in the development of Queen Elizabeth’s, and its multiple reinventions over the centuries, can be found in considering not just the ‘what’, but in the ‘how’ and the ‘why’.

He wrote: “As my predecessor, Dr John Marincowitz (Headmaster 1999-2011), explained at this year’s Senior Awards Ceremony, when discussing his new published history of the School, the fortunes of the School have repeatedly been shaped by the political, economic and social context of the time. He emphasised that much of the interest in the development of Queen Elizabeth’s, and its multiple reinventions over the centuries, can be found in considering not just the ‘what’, but in the ‘how’ and the ‘why’.

“The theme of Black history is timely: through the launch of our long-term vision for a broad, diverse and inclusive curriculum, we seek to build on the very thoughtful work that has already been done at the School, ensuring that our pupils are well-equipped to thrive in our diverse, modern world.”

“The theme of Black history is timely: through the launch of our long-term vision for a broad, diverse and inclusive curriculum, we seek to build on the very thoughtful work that has already been done at the School, ensuring that our pupils are well-equipped to thrive in our diverse, modern world.” Aston Daniel looks in more detail at the work of Sir Arthur, while a piece from Avinash is entitled How Does Systemic Racism Continue to Impact Economic Outcomes for African Americans? and Keith Correia writes on How was the war on drugs in the US used as a segregation tool?

Aston Daniel looks in more detail at the work of Sir Arthur, while a piece from Avinash is entitled How Does Systemic Racism Continue to Impact Economic Outcomes for African Americans? and Keith Correia writes on How was the war on drugs in the US used as a segregation tool?